Do Not Pass Go! Public Citizen Demands Accountability From Equifax and Wells Fargo at Congressional Hearings

By

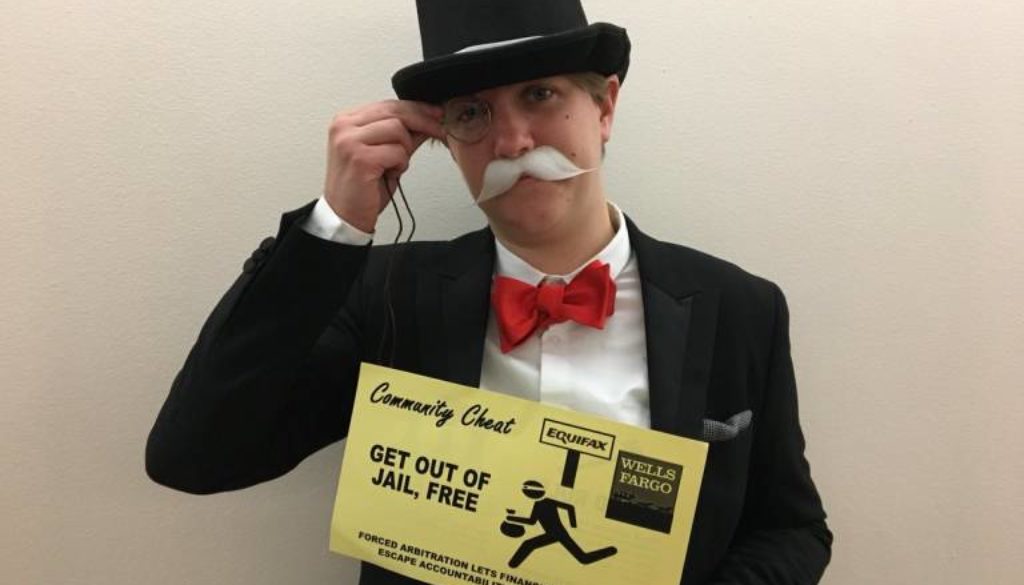

Some call him Monopoly Man. Others know him as Rich Uncle Pennybags. This week, the familiar figure was front and center both on Capitol Hill and across social media, personifying corporate greed and excess as the CEO of Wells Fargo and Equifax’s former chief testified at a combined total of five hearings on the corporate ripoffs and abuses that are engulfing both companies.

Rich Uncle Pennybag’s presence on Capitol Hill had another message, though: the stunt was meant to highlight how companies like Equifax and Wells Fargo use forced arbitration clauses in their contracts as “get-out-of- jail-free cards,” escaping accountability and transparency for their widespread corporate wrongdoing. That’s because forced arbitration clauses push disputes into secretive arbitration proceedings rigged to favor financial companies and conceal lawbreaking from regulatory authorities. For example, when Wells Fargo customers finally complained about accounts being opened in their name, they were forced into arbitration away from public scrutiny. As a result, the scandal went on for much longer than if customers had been allowed to bring their claims to open court.

In response to this abusive practice, the U.S. Consumer Financial Protection Bureau (CFPB) finalized a rule allowing consumers to join together in class actions to challenge wrongdoing in court. But now, the U.S. Senate leadership is pushing to strike down the rule using the Congressional Review Act. We have until early November to make sure their proposal does not “pass go.”

As a result of forced arbitration clauses, Wall Street rakes in record profits while Main Street suffers. Sadly, it appears that Uncle Pennybag’s presence made the CEOs more uncomfortable than some questions from members of Congress. Congress can and should do more to bring about lasting reform to the culture of greed and corruption by:

- Protecting the CFPB rule that will restore consumers’ right to join together and hold bad actor companies accountable;

- Passing legislation that gives all consumers the right to free credit freezes;

- Requiring financial institutions and other public companies to disclose their lobbying and political expenditures so the American people can better understand corporate influence-peddling.

If you saw Rich Uncle Pennybags sweating at the hearing, it’s likely because corporations know that the days of using forced arbitration to turn a blind eye to greed and wrongdoing are nearing their end.

If you saw Rich Uncle Pennybags sweating at the hearing, it’s likely because corporations know that the days of using forced arbitration to turn a blind eye to greed and wrongdoing are nearing their end.

Public Citizen is standing with hardworking Americans to demand real accountability from big banks and corporations that place profits over the interests of regular folks who play by the rules.

You can lend your voice to this fight by signing a petition here urging your senator to protect consumers and the CFPB rule. And maybe, just maybe, if enough people join the fight, we’ll end the use of forced arbitration clauses that monopolize our justice system and stop the practice of railroading consumers into a forum where they have little chance of winning.