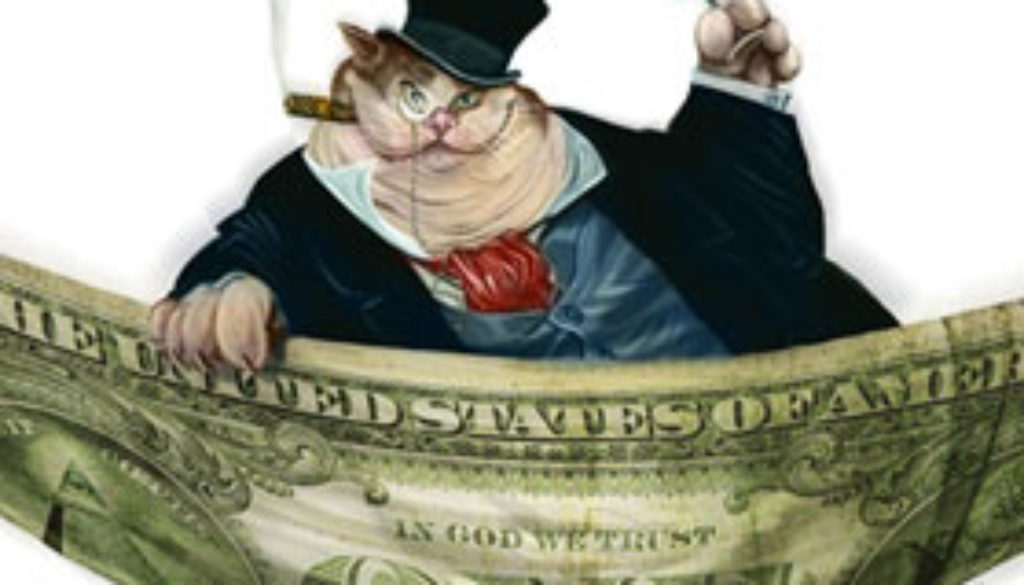

What’s at Risk at CFPB: Ability to Deliver Relief to Victims of Financial Flimflams

By Jim Lardner, Americans for Financial Reform

When a financial flim-flammer scatters to the wind or goes bankrupt, its victims are typically out of luck. But when the Consumer Financial Protection Bureau is on the case, the story can have a better ending.

Just in the past three months, the CFPB has sent over $100 million to an estimated 60,000 victims of a sham debt-relief company, Morgan Drexen, that went bust after collecting up-front fees for services it mostly never delivered.

The CFPB’s ability to bring a measure of justice to Morgan Drexen’s defrauded customers rested on authority granted by Congress. It works like this: When a solvent company is caught breaking the law, the bureau orders that company — Wells Fargo, let’s say — to make restitution to its victims. But that is only part of the remedy. The Dodd Frank Act, which set up the CFPB, gives it the additional power to levy a civil penalty — both to discourage further wrongdoing by the company involved, and as a warning to others. That money goes into a fund that the CFPB can use to deliver relief to those ripped off by malefactors who are no longer in a position to pony up.

By this means, the CFPB has delivered nearly $500 million in relief to hundreds of thousands of people, including the victims of scammers who, among other things:

- Used costly up-front fees and “third-party” services to dupe homeownersinto paying higher than advertised interest on mortgage loans;

- Offered bogus help reducing mortgage payments while falsely claiming to be affiliated with government agencies;

- Charged holders of high-cost student loan debt for income-driven payment plans they could have enrolled in for free;

- Wooed thousands of consumers into signing up for phony credit cards; and

- Stuck servicemembers with illegally expensive consumer loans by artificially inflating the prices of the electronic products they were financing.

Will the bureau be able to go on providing that sort of help? OMB Director Mick Mulvaney arrived at the bureau on Monday claiming to be its interim director. One of the first things he did was to announce that payments from the victim compensation fund would be suspended for at least 30 days.

No big surprise, perhaps, from an anti-consumer ideologue who has called the CFPB a “sick, sad joke,” and, as a congressman, voted again and again for measures to curb its authority, funding, and political independence.

The victims of the Morgan Drexen scam were particularly lucky to have the CFPB on their side. Down to their last dollars in many cases, they had turned to the firm to reduce their debt burden, only to get swindled. Restitution came as a happy surprise to most of them. One grateful Florida man received a check for $1550. A real helping hand for real people.