CFPB Complaint Volume Sets Another Record in May

By Ed Mierzwinski, U.S. PIRG

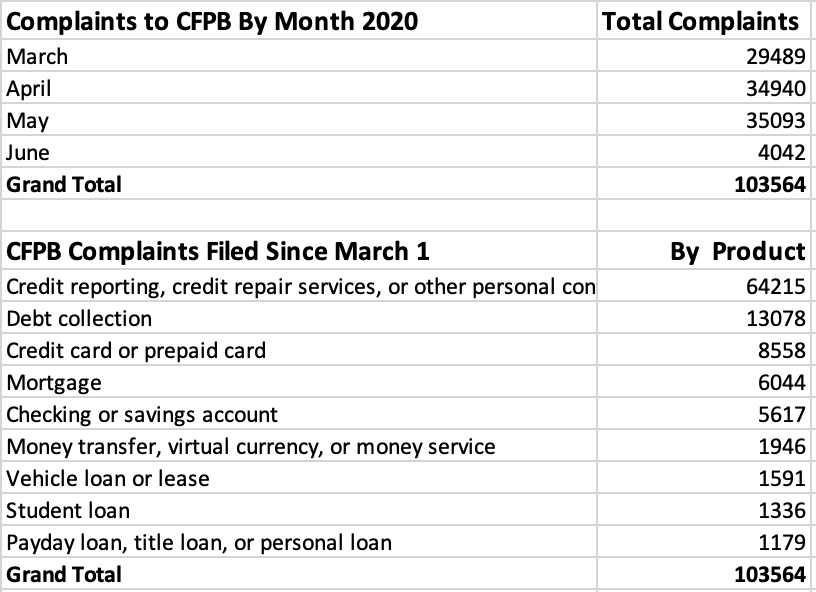

As of today, consumer complaints to the CFPB set a third straight monthly record in May, with 35,093 complaints reported. Complaints about credit reporting lead by far, followed by debt collection, credit card and mortgage complaints. Job and income losses during the pandemic are hitting families hard.

I’m still reading the CFPB’s mail. As of today, consumer complaints to the CFPB set a third straight monthly record in May, with 35,093 complaints reported so far. See chart below. Complaints about credit reporting lead by far, followed by debt collection, credit card and mortgage complaints. It’s clear from these data that job and income losses during the pandemic are hitting families hard.

In the next few days, we intend to do a deeper dive into these complaint patterns, including an updated look at complaint narratives that mention the pandemic’s impact on consumer finances. Our recent report has more on historic CFPB complaint levels. Even the CFPB is reporting that the pandemic is resulting in record numbers of consumer complaints to the public consumer complaint database. Yet, we agree with former CFPB senior official Diane Thompson, whose post today questions a variety of CFPB efforts to weaken requirements on banks and credit bureaus instead of looking at the data and using it to help consumers.

I encourage more of you to look at the consumer complaint database. If you scroll down the menu on the left side of that page, you can set your own search parameters and search right there on the CFPB website. You can set a date range (Change “From” to 3/1/2020, for example) and search by individual product or all products (the CFPB calls the categories in our chart below “products”). You can search by “sub-products” or “issues.” Issues explain the consumer’s problem. You can see your results right there and take screen shots of the results.

If you switch from “map” to “list” view you can more easily scroll through narratives. In that menu at the left, scroll down and you can select “only complaints with narratives” to only search complaints containing a voluntary narrative explaining the problem in the consumer’s own words. Here’s a search string — “covid OR coronavirus OR pandemic OR (corona AND virus) OR (global AND virus)” (delete the quotation marks) — which you can paste into the “enter your search terms” window to only find complaints that use a COVID19 term in those posted narratives.

Explore the CFPB database. It’s a window into what’s happening in our financial lives during this pandemic. It’s a resource that the CFPB itself should not be ignoring. If more people write about COVID and consumer money problems, maybe the CFPB will change its attitude. The victims of this pandemic are not the companies the CFPB is loosening the reins on; the victims of this pandemic are real people, who face the risk of getting sick at the same time as they are having trouble paying their bills.

From a recent credit card complaint narrative: “Add their constant calling to this COVID virus and it’s enough to make a person scream. Do they not know that a disaster is happening? Are they just really that cold?”

Unfortunately, I’ve read a lot of complaints and that’s the only kind of “forbearance” a lot of people seem to be receiving. Consumers are screaming. Why isn’t the CFPB listening?

Note: Complaint volumes for May are likely to increase slightly as companies complete reporting to the CFPB on complaints filed in May.