Half of CFPB Complaints in 2019 About Credit Reports as House Brings Reforms to the Floor

By Ed Mierzwinski, U.S. PIRG

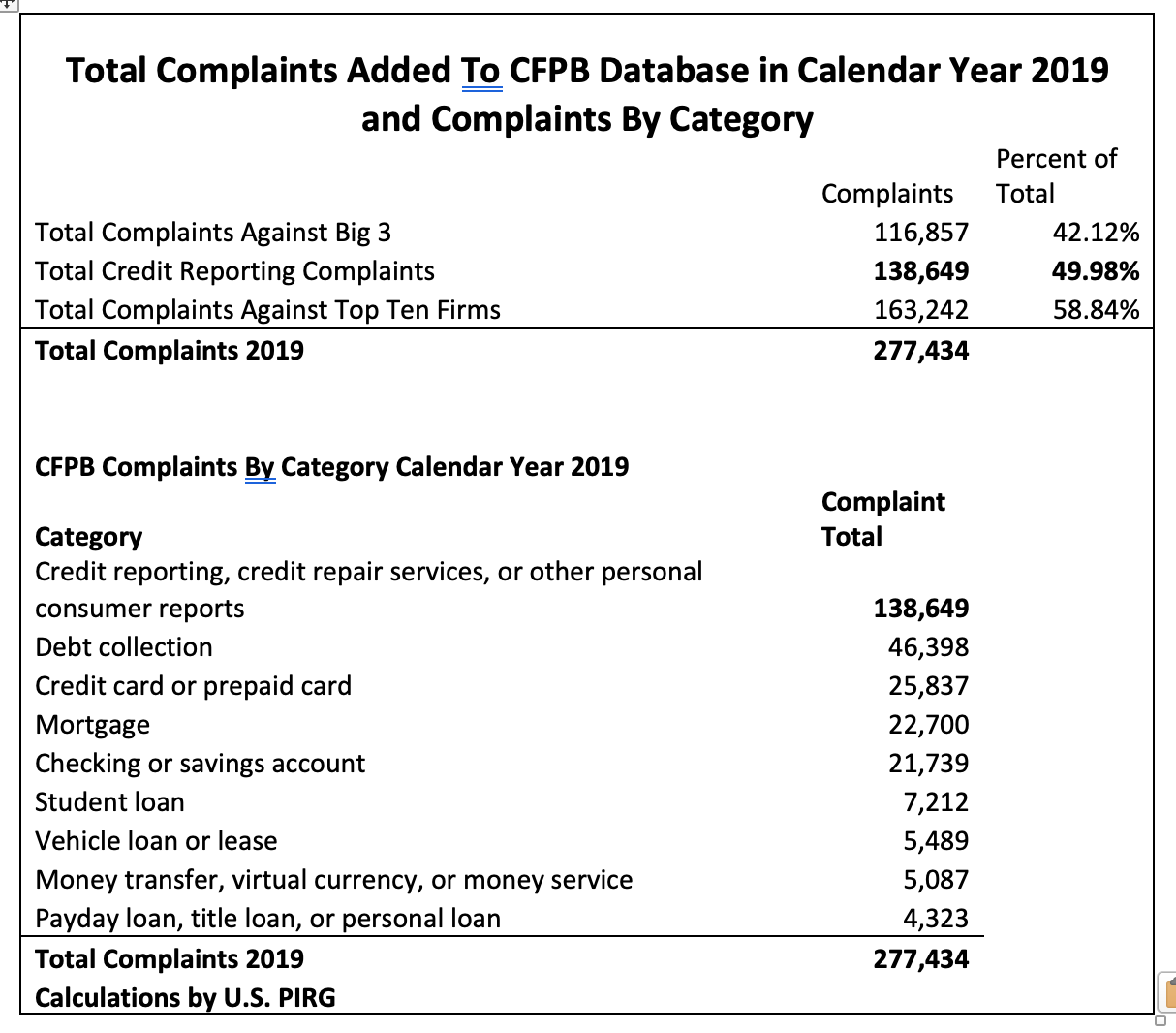

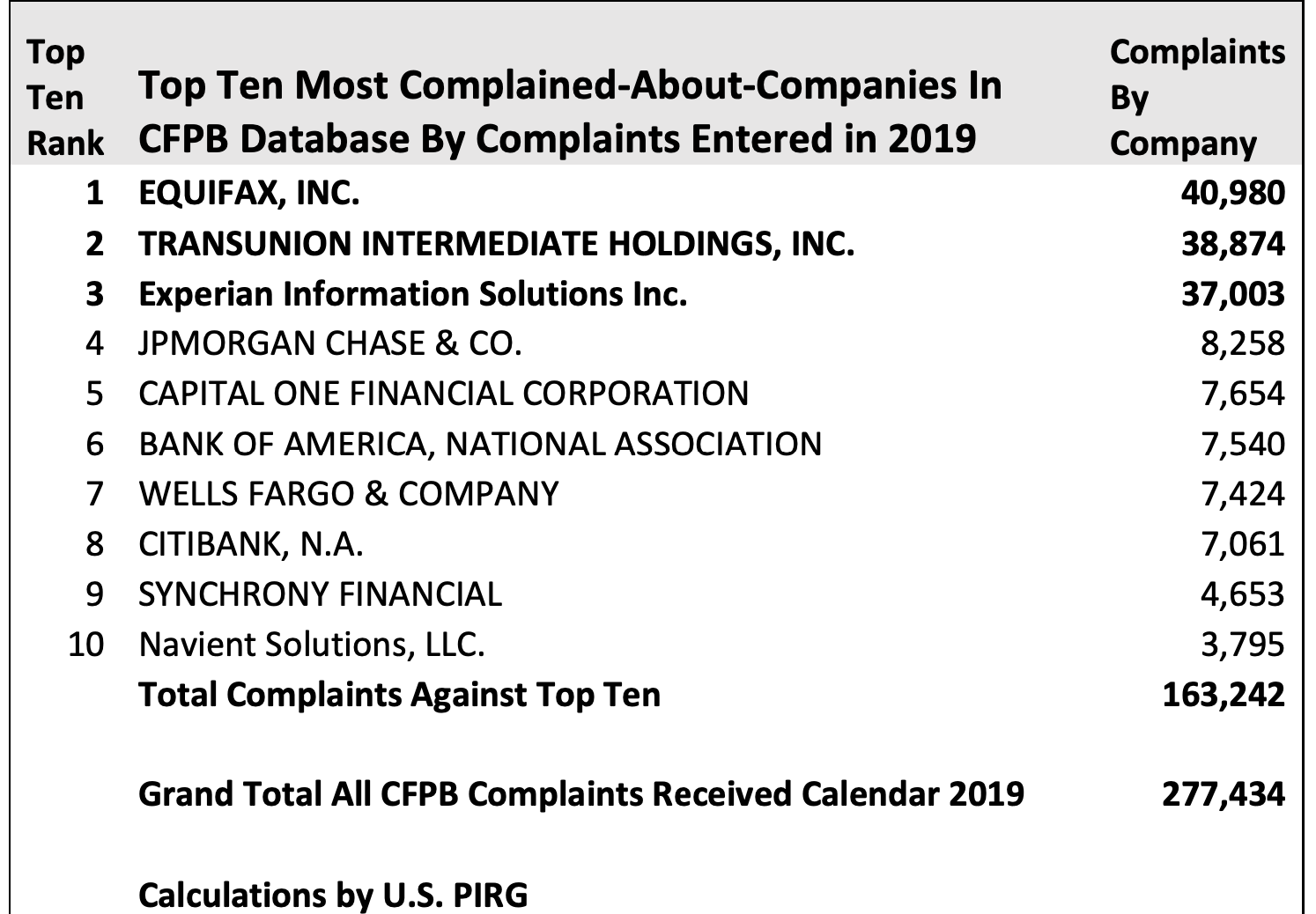

On Wednesday, 29 January, the full U.S. House is expected to vote on a broad credit reporting reform package, HR3621, the Comprehensive CREDIT Act. Meanwhile, a PIRG analysis finds that half of all complaints reported into the CFPB’s Public Consumer Complaint Database in 2019 concerned credit reporting. Further, complaints about the Big 3 credit bureaus led complaints from all other companies, with Equifax (#1), TransUnion (#2) and Experian (#3) leading the “Top Ten” most-complained-about firms.

The Comprehensive CREDIT (Credit Reporting Enhancement, Disclosure, Innovation, and Transparency) Act of 2020 is supported by over 85 leading consumer and civil rights groups, including Americans for Financial Reform, the National Consumer Law Center (NCLC) and U.S. PIRG. Both NCLC and U.S. PIRG testified in favor of the bill at a hearing before the House Financial Services Committee last year. They and other consumer and civil rights advocates described the numerous problems with the credit reporting system, including the extreme difficulty consumers face when seeking reinvestigations of mistakes. Mistakes lower credit scores and cause consumers to pay more, or be denied credit or insurance or even a job.

Key elements of HR3621 would do the following (Note that the House Financial Services Committee had passed six bills on credit reporting, including (HR3621, originally the Student Borrower Credit Improvement Act). For the purposes of floor action, all 6 bills were re-packaged together as HR3621, the Comprehensive CREDIT Act:

- Fixes the broken system for credit reporting disputes by (1) giving consumers a new right to appeal the results of initial disputes; (2) requiring CRAs and furnishers of information to dedicate sufficient resources and provide well-trained personnel to handle disputes; (3) requiring CRAs to conduct an independent analysis of disputes, separate from that of the furnisher; and (4) requiring furnishers to retain records for the same time period that negative information remains on reports.

- Provides that when consumers request their free annual credit by law, a free credit score is included.

- Narrowly restricts the use of credit reports for employment purposes.

- Limits the reporting of medical debt, which is often wrong and, further, not predictive of credit default.

- Shortens the period delinquencies can be reported on consumer reports from 7 to 4 years and most bankruptcies from 10 to 7 years.

- Give struggling private student loan borrowers achance to rehabilitate their credit.

This is just a partial list of improvements to the credit reporting system that HR3621, the Comprehensive CREDIT Act, would make to help consumers get a better shot at obtaining credit, insurance or employment. It would also help free consumers from the Kafka-esque nightmare of fixing mistakes on their reports by holding the credit bureaus much more accountable to consumers. We’re not their customers, but they sell information about us. We can’t vote with our feet for a new credit bureau but we deserve the right to make sure that what they say about us is true.